All Categories

Featured

Table of Contents

For instance, if the property owner pays the passion and penalties early, this will reduce your return on the investment. And if the house owner proclaims insolvency, the tax lien certificate will certainly be subordinate to the home loan and federal back tax obligations that are due, if any kind of. One more danger is that the value of the home can be less than the amount of back taxes owed, in which instance the property owner will have little motivation to pay them.

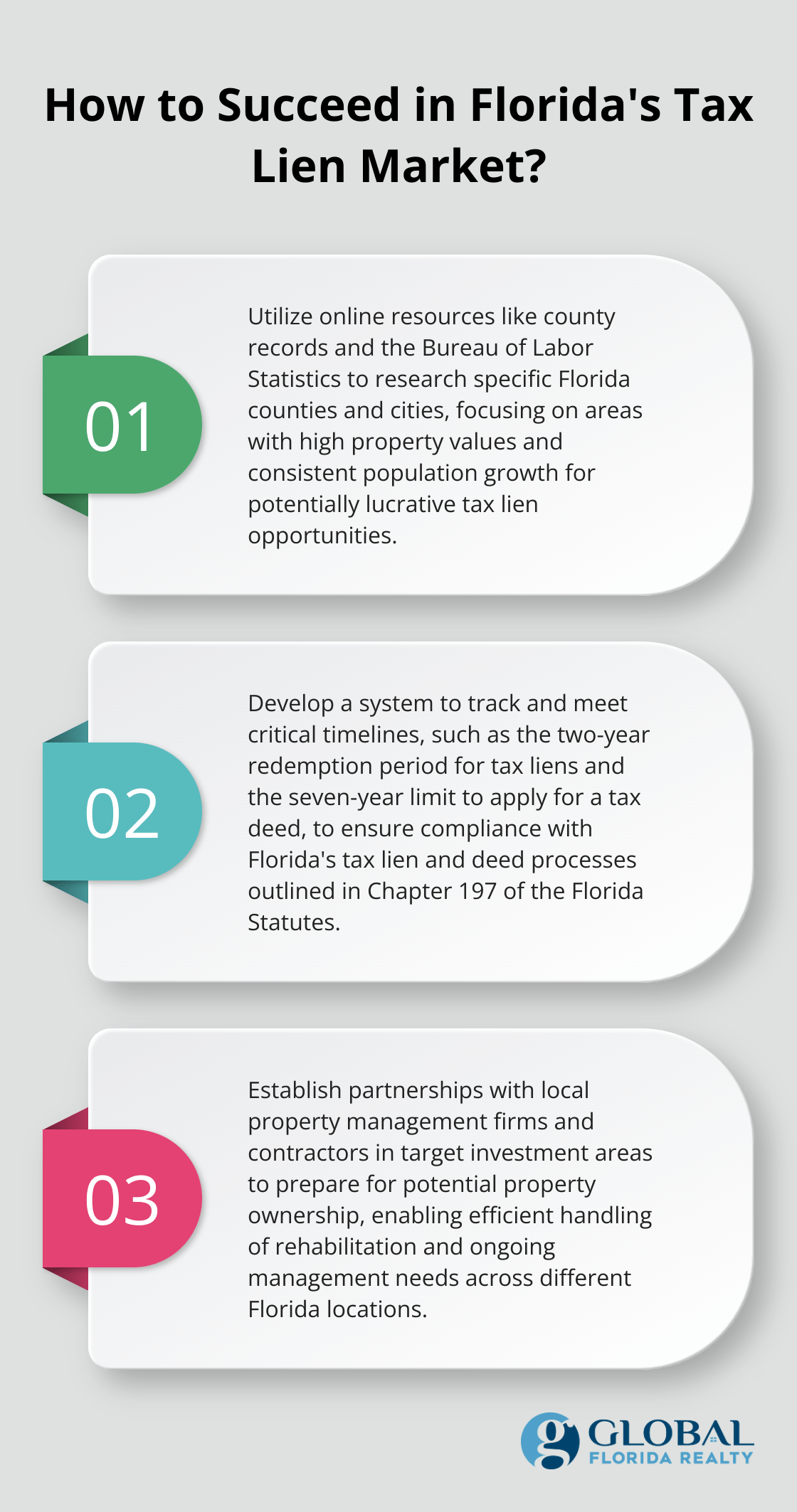

Tax lien certificates are typically offered through public auctions (either online or in person) performed every year by county or metropolitan taxing authorities. Offered tax obligation liens are normally published a number of weeks prior to the public auction, together with minimal bid amounts. Check the web sites of areas where you have an interest in buying tax liens or call the county recorder's workplace for a checklist of tax obligation lien certificates to be auctioned.

What Is Tax Lien Certificate Investing

Most tax obligation liens have an expiry day after which time your lienholder civil liberties run out, so you'll require to relocate quickly to boost your chances of optimizing your financial investment return. Tax obligation lien investing can be a successful way to buy realty, but success calls for complete study and due persistance

Firstrust has greater than a decade of experience in providing funding for tax obligation lien investing, along with a devoted group of qualified tax obligation lien experts who can aid you leverage prospective tax obligation lien spending possibilities. Please contact us for more information regarding tax lien investing. FT - 643 - 20230118.

The tax obligation lien sale is the last action in the treasurer's initiatives to gather taxes on genuine building. A tax obligation lien is positioned on every area residential property owing taxes on January 1 each year and stays up until the home taxes are paid. If the homeowner does not pay the residential property tax obligations by late October, the county offers the tax lien at the annual tax obligation lien sale.

The capitalist that holds the lien will be informed every August of any overdue tax obligations and can recommend those tax obligations to their existing lien. The tax obligation lien sale enables tiring authorities to get their allocated revenue without needing to await delinquent taxes to be collected. It additionally provides a financial investment possibility for the public, members of which can buy tax obligation lien certifications that can potentially earn an appealing rates of interest.

When redeeming a tax obligation lien, the homeowner pays the the delinquent tax obligations in addition to the overdue interest that has actually built up against the lien considering that it was marketed at tax obligation sale, this is attributed to the tax lien holder. Please get in touch with the Jefferson Area Treasurer 303-271-8330 to acquire payback information.

What Is Tax Lien Real Estate Investing

Home becomes tax-defaulted land if the building tax obligations stay unpaid at 12:01 a.m. on July 1st. Home that has actually ended up being tax-defaulted after five years (or 3 years in the case of residential or commercial property that is also subject to a nuisance reduction lien) comes to be based on the region tax collection agency's power to offer in order to please the defaulted residential property taxes.

The county tax collector might supply the property up for sale at public auction, a secured quote sale, or a negotiated sale to a public company or qualified not-for-profit company. Public auctions are one of the most usual method of marketing tax-defaulted home. The auction is performed by the area tax obligation collector, and the home is offered to the greatest bidder.

Secret Takeaways Navigating the globe of real estate investment can be intricate, but understanding various financial investment possibilities, like, is well worth the work. If you're wanting to expand your portfolio, spending in tax obligation liens may be an alternative worth exploring. This overview is created to help you comprehend the fundamentals of the tax lien investment method, assisting you with its process and aiding you make notified decisions.

A tax obligation lien is a lawful insurance claim imposed by a federal government entity on a residential or commercial property when the owner fails to pay real estate tax. It's a way for the federal government to make certain that it gathers the required tax profits. Tax liens are connected to the residential property, not the person, meaning the lien sticks with the residential or commercial property no matter ownership modifications till the financial obligation is gotten rid of.

Certificate Investment Lien Tax

Tax lien investing is a kind of real estate investment that involves buying these liens from the federal government. When you spend in a tax obligation lien, you're basically paying somebody else's tax financial obligation.

The local government then puts a lien on the home and might eventually auction off these liens to investors. As a financier, you can acquire these liens, paying the owed tax obligations. In return, you receive the right to accumulate the tax financial obligation plus interest from the homeowner. This rate of interest price can differ, but it is commonly higher than typical savings accounts or bonds, making tax obligation lien investing potentially profitable.

It's necessary to very carefully weigh these before diving in. Tax obligation lien certification investing deals a much reduced capital requirement when contrasted to other types of investingit's possible to delve into this property course for as low as a pair hundred bucks. Among one of the most significant attracts of tax obligation lien investing is the possibility for high returns.

In some instances, if the homeowner fails to pay the tax debt, the capitalist might have the possibility to confiscate on the building. This can potentially bring about acquiring a property at a fraction of its market value. A tax obligation lien typically takes top priority over other liens or mortgages.

This is because, as the initial lien owner, you will be called for to purchase any type of succeeding liens. (New tax liens take precedence over old liens; depressing however real.) Tax lien investing involves browsing lawful treatments, especially if repossession becomes needed. This can be complicated and may call for legal support. Redemption Periods: Homeowner usually have a redemption duration during which they can pay off the tax debt and interest.

Affordable Public auctions: Tax obligation lien public auctions can be extremely competitive, especially for properties in desirable areas. This competitors can drive up rates and possibly lower general returns.

How To Invest In Tax Liens Online

While these procedures are not complicated, they can be unexpected to brand-new investors. If you have an interest in starting, examine the complying with steps to purchasing tax liens: Start by educating on your own concerning tax liens and just how property auctions function. Recognizing the lawful and economic complexities of tax lien investing is vital for success.

Latest Posts

Delinquent Tax Houses

Purchase Delinquent Property Tax

How To Find Properties That Owe Taxes